Famous for its Golden Visa Program, Portugal is a popular retirement destination for high-net-worth individuals (HNWIs). That said, you don’t need to spend hundreds of thousands of euros on Portuguese real estate just to become a resident in the country.

Most football fans already know that Portugal is the birthplace of Cristiano Ronaldo but, in this article, I’m going to go over everything you need to know before choosing to retire in this coastal nation!

Table of Contents

Cost of Living in Portugal

Portugal is one of the cheapest countries in Western Europe to live in.

It’s rent prices are comparable to neighboring Spain with a one-bedroom apartment outside the city center costing less than $600 per month. Housing does become more expensive around the capital with a three-bedroom apartment in Lisbon costing over $2,000 per month.

Here’s a preview of what life in Lisbon could look like:

Portugal also has an affordable public transportation system consisting of trains, trams, and funiculars across the country. You’ll also be able to find clean buses and taxis to help you get to specific destinations faster.

If you’re travelling between large cities like Lisbon or Porto then taking the Alfa Pendular trains will be the fastest way to get around — boasting speeds of up to 220 km per hour (which gets you from the southernmost point of the country to the northernmost point in under six hours.)

Taxes in Portugal

Portugal is one of the highest tax countries in Europe with progressive income tax rates of up to 48% on worldwide income. Taxpayers with an annual income of €80,000 or more are also subject to a solidarity tax of 2.5% to 5%.

How to Become a Permanent Resident in Portugal

Before you can apply for a permanent residence permit in Portugal, you first need to spend five years in the country under a temporary residence permit. Requirements for a temporary residence permit in Portugal include:

- Depositing $3,000 per person into a Portuguese bank.

- Proof of regular monthly income (active or passive) equivalent to at least €1,070.

- Health and accident insurance.

After five years, you’ll be eligible to apply for the Golden Visa Program.

To get your golden visa in Portugal, you’ll need to purchase real estate worth €500,000 or more. If you buy properties in rural regions or urban regeneration areas then you may be able to invest €280,000 or €350,000 instead of the full €500,000.

The property must be held by the applicant for a minimum of five years but it can be used for either personal occupancy or leased to a third-party during that time period. The golden visa is renewable every two years as long as you spend one week in Portugal each year.

If you’re not a fan of buying real estate, you could invest €1,000,000 in a local company instead.

Portugal Passport Visa-Free Countries

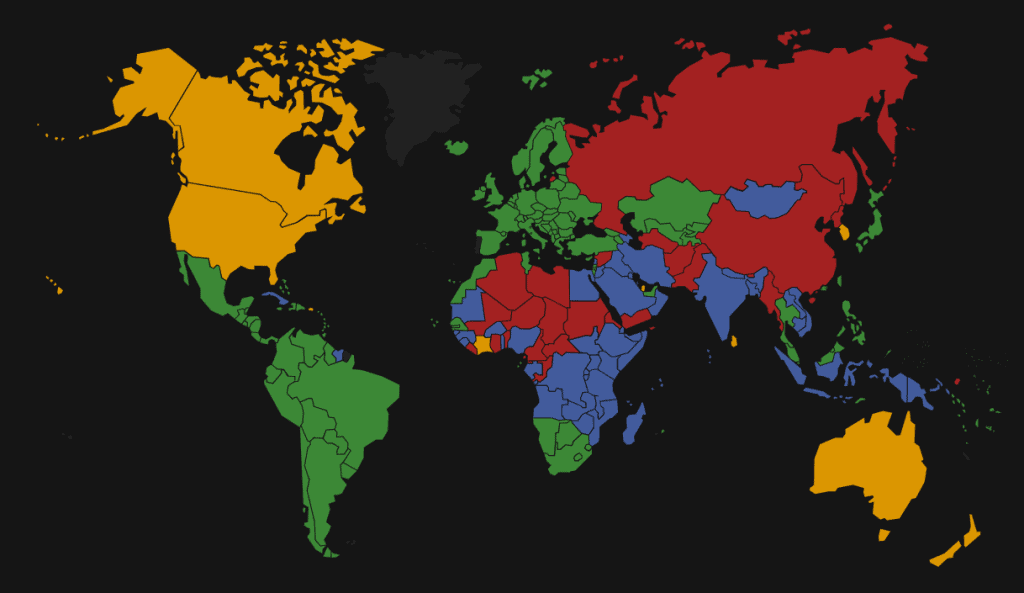

Portuguese citizens are able to travel to 116 countries visa-free:

The Portuguese passport stands at the upper echelons when it comes to visa-free coverage. In fact, it offers more visa-free options than even the United States passport (which covers 109 countries).

Citizens of Portugal will be able to travel to the entirety of Latin America, Europe, and various countries in other continents like Asia or Africa. Combine this with the modest five-year waiting period to become a naturalized citizen and it’s clear that the cost of a golden visa is well worth it.

Safety in Portugal

The US Department of State gives Portugal a level 1 classification, only asking that travelers exercise normal precautions. Furthermore, there are no cities or regions where increased caution is recommended.

According to the Global Peace Index, Portugal has the 6th lowest crime rate in the world (ahead of Japan and Singapore):

While Portugal is undoubtedly an extremely safe place to retire in, I’d recommend buying a wallet chain since pickpocketing is absolutely rampant in Lisbon.

Conclusion

As you can see, there’s a lot to love about retiring in Portugal. You’ll benefit from a low cost of living, excellent passport coverage, and incredibly low crime rates. That said, you have to be prepared for the high price of a golden visa as well as the 50% income tax rates.

Considering the fact that the income tax is more than three times what you’d pay in Hungary, I’d struggle to pick Portugal as a permanent residence when there are so many lower-tax alternatives in Europe.