There’s no question that living in the Kingdom of Spain can be great. The sunny weather, incredible food, and unyielding nightlife give you a lot to do during your time on the Iberian Peninsula.

In this article, I’m going to go over the most important information you need to know if you plan to retire in Spain!

Table of Contents

Cost of Living in Spain

The cost of living in Spain is quite reasonable, especially when it comes to rent prices.

A one-bedroom apartment outside city centers should only cost you around $600 per month. On the other hand, a three-bedroom apartment in the capital city of Madrid can cost $1,750 per month or more.

Spain is also filled with trains, trams, and buses that can get affordably get you around the country. If you want to see the country by bus then you can get a 7-day Alsa Pass for €99 which offers up to three free tickets per day.

The average Spanish household spends €5,568 on groceries every year, which is 33% less than the average American household at $8,289. Eating out is quite affordable as well with a three-course meal costing as little as €10 (though expect to spend more for dinners).

Taxes in Spain

Residents of Spain are taxed with progressive income tax rates of up to 45% on their worldwide income. Any income above €60,000 will be taxed at the maximum PIT rate regardless of where it was generated.

How to Become a Permanent Resident in Spain

The best path towards becoming a permanent resident in Spain is to apply for a non-lucrative residence visa. This residence visa allows you to live in Spain but does not include the right to get a job in the country.

To qualify, you’ll need an income of at least €25,560 per year + €6,390 for each additional family member that you’ll be bringing with you. Within a month of arriving in Spain under the non-lucrative residence visa, you’ll need to apply for a residence permit.

The permit will be valid for two years (but is renewable if you continue to meet the requirements and spend more than half of each year in Spain) and comes with a foreign national identity card.

After holding your temporary residence permit for five years, you’ll be eligible to apply for permanent residency which allows you to both live and work in Spain indefinitely. After 10 total years of residency (either temporary or permanent), you’ll be eligible for naturalization.

Spain does not recognize dual-citizenship so you’ll need to renounce your previous citizenship.

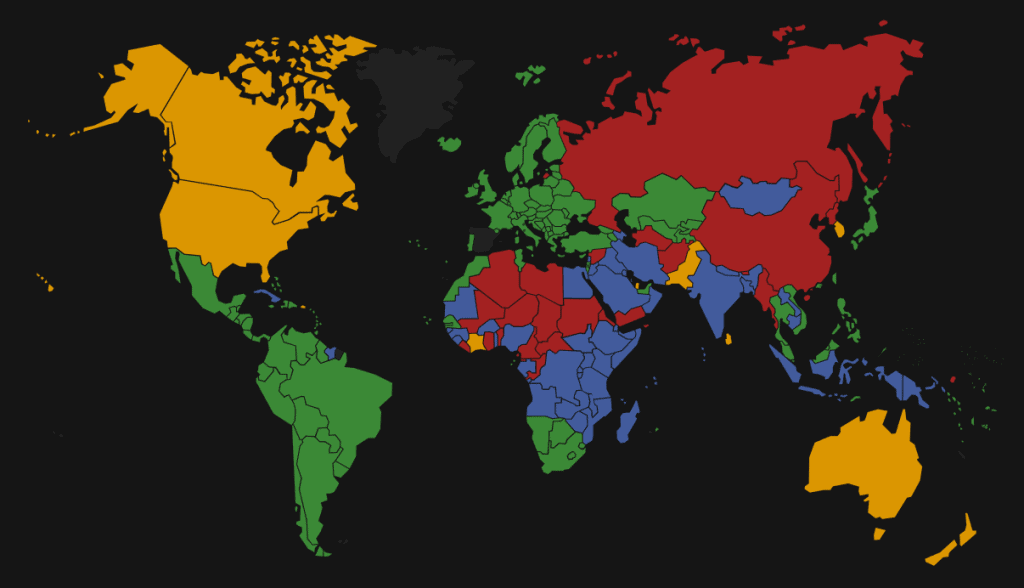

Spain Passport Visa-Free Countries

Spanish citizens are able to travel to 117 countries visa-free:

Spain has one of the strongest passports in the world offering visa-free access to 117 countries (the same number as France and Italy). This includes the entirety of Latin America and Europe — along with tourist hotspots in Asia like Thailand, Malaysia, Singapore, Japan, and the Philippines.

Spanish citizens also get Electronic Travel Authorization (eTA) access to the United States, Canada, Australia, and New Zealand. There’s hardly anywhere in the world that a Spanish passport can’t take you.

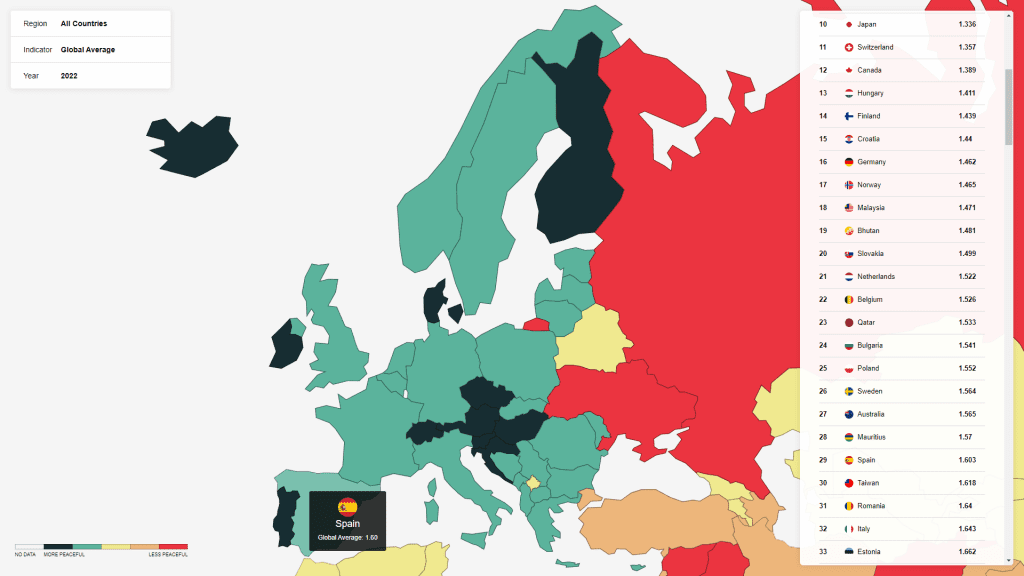

Safety in Spain

When you look at the Global Peace Index, it’s clear that Spain’s low crime rates are in line with other countries in Western Europe such as Italy, Poland, and the Netherlands:

However, it’s worth noting that the US Department of State gives Spain a level 2 (increased caution) classification due to terrorism. Terrorism (along with civil unrest) is one of the reasons why Spain isn’t as safe as Portugal.

Conclusion

As you can see, Spain certainly has a lot to offer with its good food, ideal weather, and high level of safety. In fact, my grandfather was from Barcelona and he only ever had good things to say about his homeland.

That said, the high tax rates and risk of terrorist attacks do somewhat undercut the otherwise appealing combination of affordable rents plus a powerful passport. In the end, it will come down to how import safety and tax rates are to you.

Personally, I would prefer a safer and lower-tax option like Malta or Andorra.