Montenegro may not be the most popular destination in Europe but, if you’re looking for a country to plant roots in, it’s definitely a country worth considering. Not only is Montenegro one of the cheapest countries in Europe, but it’s also a great spot for hiking, rafting, and skiing.

Let’s have a closer look at the benefits of living in this affordable and multicultural nation!

Table of Contents

Cost of Living in Montenegro

Cost of living is much lower in Montenegro compared to most other countries in Europe. Renting a one-bedroom apartment outside the city center of Podgorica will cost you around $250/month. If you want to live in the capital’s city center, expect to pay an extra hundred.

Despite not being a member of the European Union, Montenegro uses the Euro as its currency which means you won’t have to worry about exchange rates whenever you take a road trip to nearby countries.

The fact that Montenegro isn’t in the European Union can actually have its fair share of benefits.

Mainly, your time spent in Montenegro won’t count towards the Schengen 90/180-day rule. This makes Montenegro the perfect place to hunker down every other three-month period while you wait for your Schengen access quota to reset.

When it comes to traveling within the country, you’ll definitely want to buy a car. Public transportation does exist but it doesn’t get much funding due to Montenegro’s low population density.

Still, you can take a one-hour train from the capital of Podgorica to the coastal town of Bar for less than $5. Once you’re there, you can hop on the weekly 11-hour ferry to Bari, Italy or board a voyage towards multiple Croatian cities.

Taxes in Montenegro

You may have heard that the the personal income tax rate in Montenegro is just 9%. This is only true for those earning between €8,400 and €12,000. Those earning more than €12,000 annually will be placed in the 15% income tax bracket which is still lower than most of Europe.

In fact, 15% puts it exactly in line with Malta.

The difference is that Montenegro taxes its residents on their worldwide income while Malta only taxes income remitted to the country. However, Malta has a €15,000 minimum annual tax while Montenegro doesn’t.

The better option will come down to how much money you earn and where it comes from.

Montenegro taxes capital gains at a flat rate of 9% which means you’ll end up paying less in tax if most of your cashflow comes from investments rather than active income. There’s also a local surtax that will be levied by the municipality you live in.

The total surtax amount will be equivalent to 13% to 15% (depending on the municipality) of what you paid in federal income taxes. Non-residents only pay income tax on their immovable property located in Montenegro which makes the tax structure favorable for digital nomads.

Annual property taxes in Montenegro range between 0.25% and 1% but the person using the property is the one liable for the bill rather than the owner. This means that taxes for real estate you choose to rent out would be the responsibility of the tenant.

How to Become a Permanent Resident in Montenegro

The easiest way to get a permanent residency permit in Montenegro is to buy real estate. By investing at least €250,000 into real estate, you’ll be able to live in the country, qualify for future citizenship, and even rent out the property during the peak tourism months every summer.

You’ll need to have health insurance if you want to apply for a residency permit or renew your existing permit but healthcare in Montenegro is quite affordable anyway. Consultations with specialists often cost as little as €30.

Some people choose to leave Montenegro every 90 days then renew their visa to come back. That said, this approach isn’t a viable long-term approach if you want to work in the country, enroll your kids in a local school, or apply for citizenship in the future.

Montenegro Passport Visa-Free Countries

Getting Montenegrin citizenship isn’t exactly a quick process but it can certainly be worth it in the end. To get become a citizen of Montenegro, you’ll need to hold a temporary residence permit for five years followed by five years spent as a permanent resident.

After the decade-long wait, you’ll finally have spent enough time in the country to be eligible for Montenegrin citizenship. This will give you access to the entirety of Europe (except for the United Kingdom and Republic of Ireland) plus most countries in South America.

Guyana, Suriname, and Paraguay are the three “hard exceptions” since you can get a 90-day visa upon arrival in Bolivia. You’ll also be able to access most Caribbean islands with your Montenegrin passport.

You’ll have to get a visa when visiting North America, Asia, Africa, and Oceania though.

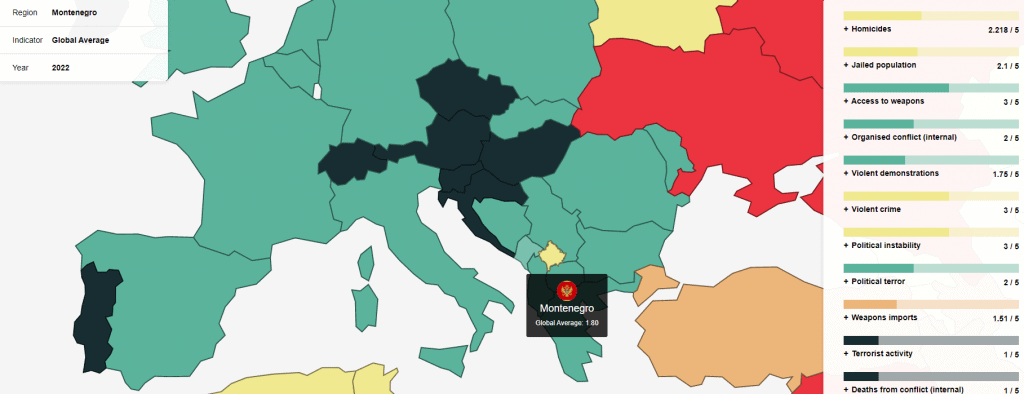

Safety in Montenegro

Crime rates in Montenegro are in line with most other European countries. That is to say, very low. You only really have to worry about scammers and pickpockets — especially in big cities during the tourist-filled summers.

Organized crime does exist in the country but tourists are rarely targeted nor affected by these illicit activities. Overall, if you use common sense, keep your hands in your pockets, and learn how to sniff out conmen then you’ll be quite safe in the country.

Conclusion

Montenegro may not be the first country that comes to mind when you think of European countries you’d like to visit but it definitely has its own unique benefits. The affordable cost of living, low income tax rates, and panoramic coastal views make for a great combination.

The fact that the country uses the Euro as its currency and most residents of big cities speak good English means that adjusting to life in Montenegro won’t be too hard. If you’re still on the fence, why not check out my guide on other low-tax European countries to retire in?