If you’ve spent the past few decades saving up for retirement instead of traveling the world, you’re probably eager to get out of the country. However, answering the question of where to retire is a much trickier task.

In this article, I’m going to walk you through six different factors that can help you identify the ideal retirement country. I’ll also give you a recommended list of retirement destinations for every continent (except Antarctica, for obvious reasons).

Table of Contents

How to Choose a Retirement Spot – 6 Factors to Consider

Moving to a new country is a big step. Before committing to a country, here are three major factors you need to consider:

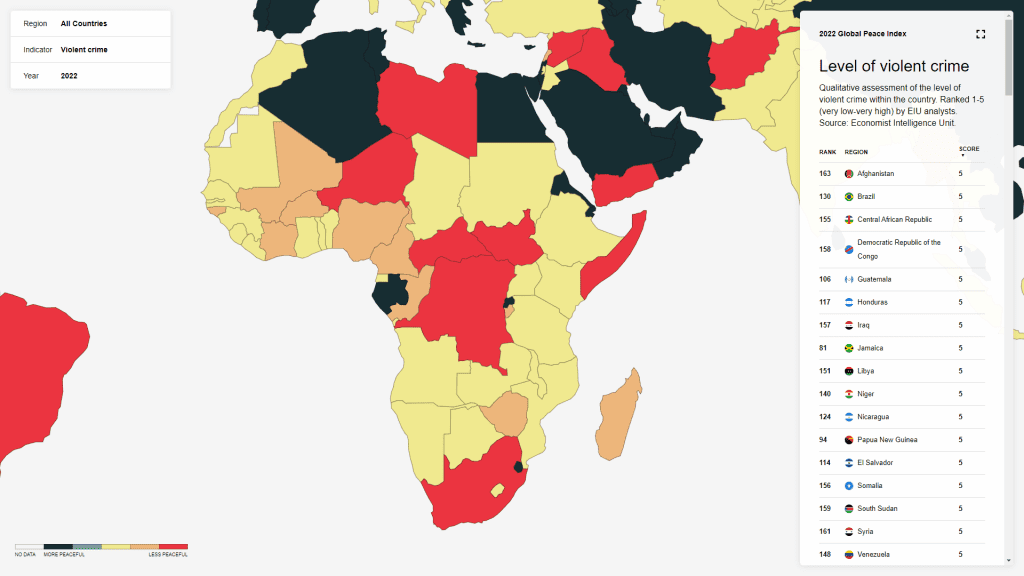

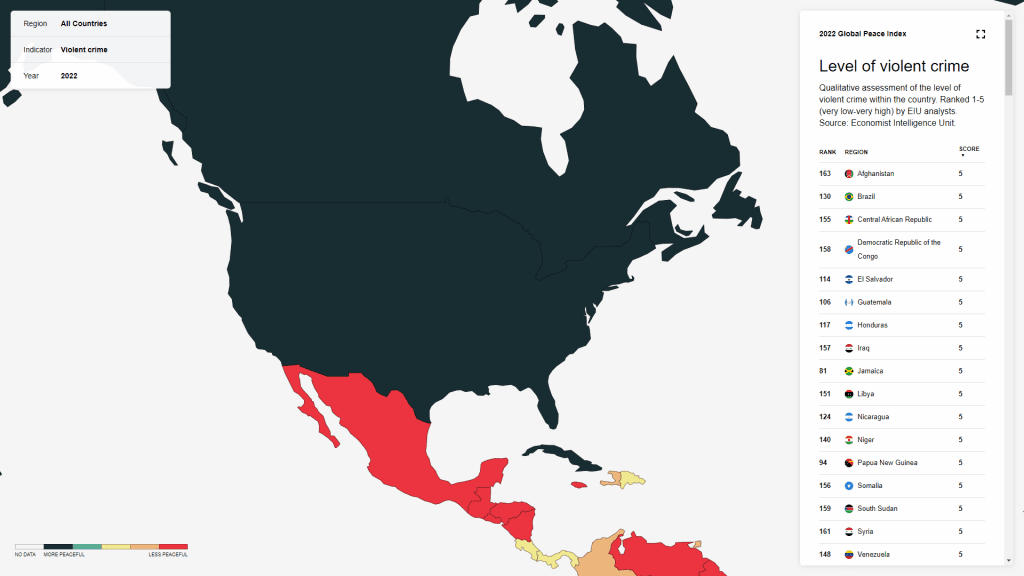

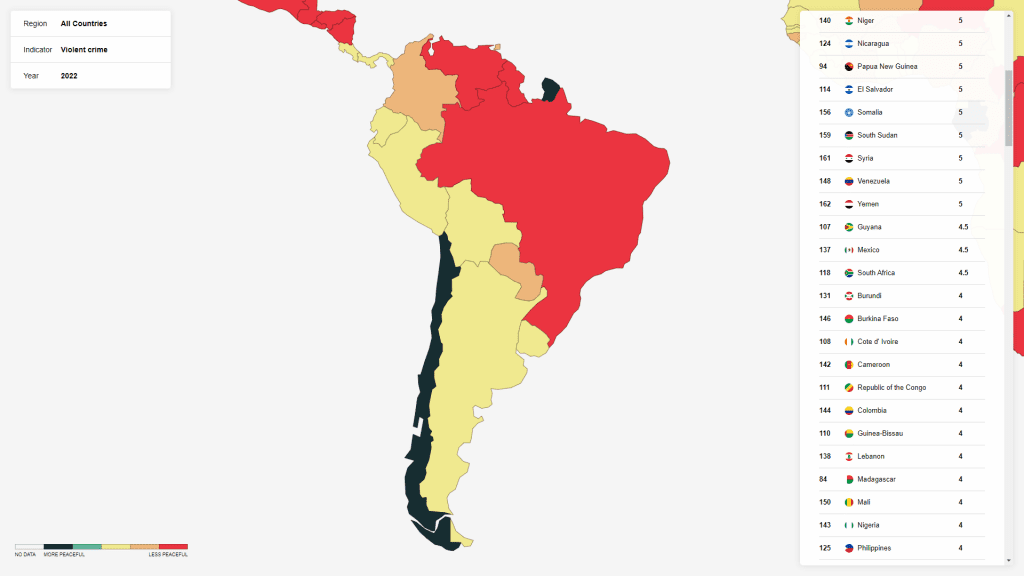

- Safety. The quickest way to measure a country’s safety is to look at the violent crime rates on the Global Peace Index from Vision of Humanity. You can also look at travel advisories from the US Department of State to get more detailed information on the risks of visiting a country.

- Cost of Living. Next to safety, cost of living is the second most important thing to consider. Your lifestyle will primarily depend on how expensive food, rent, and transportation cost. You can use Numbeo to see the cost of living for 11,000+ cities or look at their COL world map.

- Taxes. The last thing you want is to retire abroad only to be taxed to death on your foreign income remittances, capital gains, and pension payments. Here’s a list of the personal income tax rates for every country from Trading Economics.

And three supplementary factors you should consider:

- Climate. If you’re accustomed to a tropical climate then moving to a snowy nation (or vice versa) can be a difficult adjustment to make. Check out this interactive climate map to see the mean temperature in every part of the world.

- Language. If you only speak one language and aren’t willing to learn a local dialect, you may want to stick to countries that use your mother tongue. Here’s an exhaustive list of the official language(s) in every UN country.

- Population density. Living in the crowded streets of Dhaka may be too stressful for you, while being isolated in pacific islands with barely anyone around could be just as unnerving. Have a look at this interactive population density world map to find your Goldilocks zone.

Of course, you should also think about how easy it is to immigrate to a certain country. Many nations have citizenship by investment, golden visa, and/or digital nomad visa programs that can help you move to the country.

Best Places to Retire (by Continent)

There’s one-size-fits-all answer to which continent one should retire in. My ideal region would be Europe since I love road trips, classical architecture, and history-rich cities. Someone else’s idea of paradise may be living in a pacific island or exploring the Amazon rainforest.

Regardless of which continent you want to move to when you retire, you’ll be able to find a few solid recommendations in the sections below!

Best Country to Retire in Asia

Asia is a difficult nut to crack because of complicated tax structures and rent prices that vary wildly from country to country. There are also some dangerous countries that should be avoided such as Syria, Iraq, Afghanistan, and Yemen.

Most people might assume that Singapore is the best option in Asia.

The city-state is highly-developed and one of the safest countries in the world. It’s also the 3rd largest financial center (next to New York and London) according to the Global Financial Centres Index 32 published in September of 2022.

That said, there are quite a few reasons why you shouldn’t move to Singapore.

First of all, rent is super expensive with city-center apartments costing $2,500 to $5,000 per month depending on how many bedrooms you want. It’s also quite difficult to get approved for a residency permit, with more than half of all applications getting rejected.

If you somehow manage to qualify for Singaporean citizenship, you’ll have to renounce all other passports since the country doesn’t allow dual citizenship. The high tuition fees, lack of political freedom, and small size of the nation mark more turnoffs for expats.

With Singapore out of the question for most people, Malaysia might may seem like the next obvious choice. Its capital, Kuala Lumpur, is a thriving metropolis home to the Petronas Twin Towers and dozens of shopping malls.

The country has also been a popular destination due to its territorial taxation. Section 3 of Malaysia’s Income Tax Act (1967) states that only income “accruing in or derived from or received in Malaysia” is subject to income tax.

However, this changed with the Finance Act 2021 which repealed the tax exemption on foreign-source income. The Malaysian Ministry of Finance later published two exemption orders that exempts foreign-source income only if it was taxed by the country of origin at no less than 15%.

Fortunately, there’s another country further north that’s a lot more tax-friendly: Thailand.

Thailand is the best country to retire in Asia. It offers a low cost of living, multicultural environment, and a friendly population that are quite receptive to expats. Not least of all, those retiring to Thailand will benefit from the relaxed tax regulations.

The only instance in which foreign-source income would be taxed in Thailand is if you remit the money into the country in the same calendar year that it was paid. In other words, you just have to keep the income overseas for an extra year before remitting it to Thailand.

This will exclude your foreign-source income from qualifying for taxation in Thailand.

When it comes to expenses, rent won’t be much of an issue as you can get a one-bedroom apartment in the city-center of Bangkok for around $500 per month. If you’re fine with living outside the city center, you could easily see the price of rent cut in half.

Safety-wise, it gets a 3/5 violent crime score from the Global Peace Index. This is slightly higher than the 2/5 score that neighboring Laos, Cambodia, and Malaysia get — but Thailand is still considered one of the safest countries in Southeast Asia for tourists and expats.

Other roptions are available in the Gulf States as well but foreigners may struggle to adapt to the climate and culture of these countries — not to mention the high rent prices in certain hotspots like Dubai and Doha.

Best Country to Retire in Africa

When it comes to retiring in Africa, safety is the most important ranking factor to consider.

Violent crime rates in Africa are highest in its central cluster consisting of the Democratic Republic of the Congo, the Central African Republic, and South Sudan. The coastal nations of Somalia, Libya, and South Africa also have high rates of violent crime.

For this reason (and a few others that I’ll go over shortly) I’d have to say that Tunisia is the best country to retire in Africa. It has the lowest crime rate in North Africa, though terrorism is a risk in certain regions of the country.

Specifically, the border areas with Libya and Algeria should be avoided. The US Department of State also recommends avoiding Sidi Bou Zid in Central Tunisia and the country’s western mountains (including Chaambi Mountain National Park) due to terrorism.

Even if you live in the Grand Tunis metropolitan area, you should still remain vigilant of petty criminals such as pickpockets. One of the great benefits of living in Tunisia is having easy access to Europe.

There are three ferries per week that can take you from Tunisia to Italy.

These ferries have an approximate travel time of 12 to 15 hours and cost €100 to €150.

Taxation, at first glance, may seem like a deal breaker since the progressive income tax rate ranges from 26% to 35%. However, non-citizens are only taxed on their local income so this won’t be much of an issue unless you plan to get a job in Tunisia or start a business there.

The rent prices in the capital city of Tunis are incredibly affordable, with three-bedroom apartments in the city center only costing a little over $400 per month. One-bedroom apartments are even cheaper, only costing around $220 per month.

Best Country to Retire in Europe

Europe is a popular choice for tourists, expats, and retirees for many reasons. The rich history, awe-inspiring architecture, and diverse culture are just a few elements that make up the allure of living in Europe.

Unfortunately, most people can’t afford to live in landmark cities like London, Paris, and Rome.

If you’re looking for a country that’s affordable to live in, easy to move to, and won’t cost you half a million euros just to get in then I have the perfect option for you. It’s a little-known, beautiful island south of Italy.

That’s right, I’m talking about Malta!

Malta is the best country to retire in Europe for a plethora of reasons. First of all, it provides easy access to Italy and the rest of continental Europe through ferries. There are daily ferries from Malta to Italy (specifically, the Port of Augusta in Sicily) that only take three hours to arrive.

Note: once in Italy, you can take an 11-hour ferry to Montenegro to visit eastern Europe.

Many European countries are also accessible through cheap flights departing from Malta International Airport. For example, there are plenty of cheap flights to Greece for under €30 that will get you to continental Europe in under two hours.

It’s clear that Malta, while an island, is hardly remote.

Outside of the travel benefits of living in Malta, you’ll be glad to know that the cost of living is surprisingly low — especially for Europe! Rent for a one-bedroom apartment in the capital city of Valletta rarely goes over $900.

Avoid going too low though since beneficiaries of the Global Residence Programme — which I’ll go over in just a second — are required to pay annual rent not less than €9,600 (€8,750 in the South of Malta and Gozo) or purchase property worth at least €275,000 (or €220,000 in the South of Malta and Gozo).

Beneficiaries of the program also qualify for reduced tax rates. Foreign-source income that’s remitted to Malta will be taxed at a flat rate of 15%. You’ll also be subject to a minimum tax of €15,000 annually (€7,500 for pensioners) which you can reduce by paying taxes at the source.

Foreign-source capital gains are never taxed, even if you remit them to Malta.

To qualify for the program, you have to be a non-EU citizen with a net worth of at least €500,000. The minimum investment to get permanent residency in Malta is €110,000. You’ll also have to pay an additional €5,000 for each child and €7,500 for each spouse/parent/grandparent.

Children can be any age as long as they’re not married.

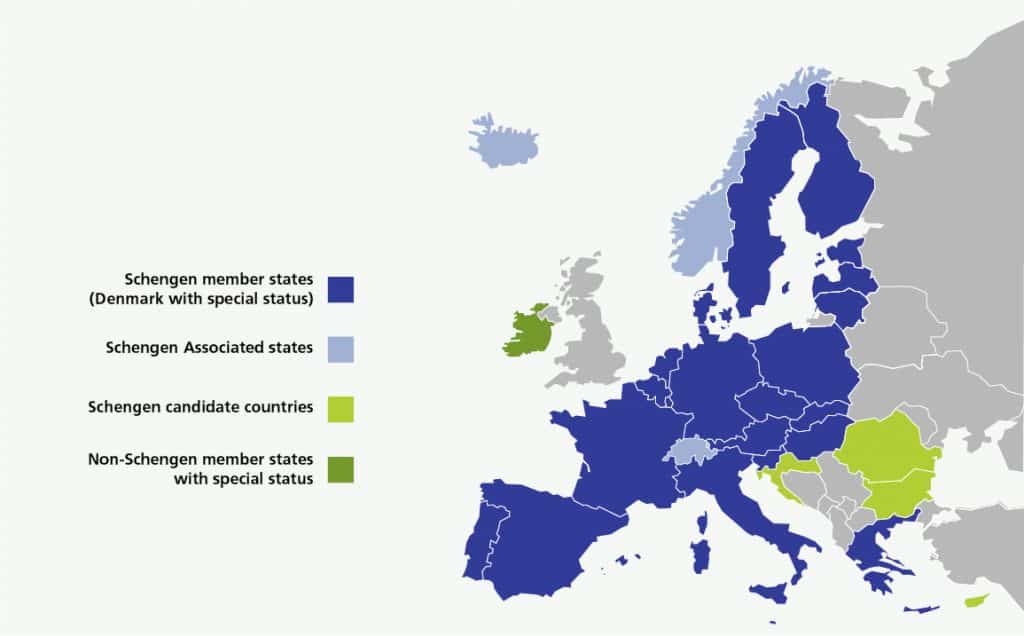

In addition to being able to live in Malta for as long as you want, you’ll also be able to freely travel the Schengen Area for 90 days in every 180-day period. If the €500,000 net worth requirement is an issue then you can consider more affordable options like Romania.

Romania has a digital nomad visa program that’s quite easy to qualify for!

As long as you’ve been employed (either full-time or part-time, outside Romania) for the past three years and earn three times the average gross salary in Romania then you can get a six-month visa.

This visa can be renewed after the initial six months, provided you still meet the requirements.

The average gross salary in Romania (after taxes) is around 6,500 lei per month. This means you would have to earn around $4,000 per month to qualify for the digital nomad visa and maintain this income level if you want to qualify for renewals.

You can see the latest Romanian salary statistics here!

A nice bonus is that you won’t be taxed on worldwide income unless you spend more than 183 days in the country every year. To learn more, read my full article on Retirement in Romania and what it’s like.

Or, to get a closer look at the beautiful nation of Malta, watch the video below!

Best Country to Retire in North America

North America is one of the most expensive continents to retire in but there are still a few noteworthy options. Most of Central America have high rates of violent crime, with the exception of Panama and Costa Rica.

Panama is the more popular option since residents are only taxed on their Panama-source income and there are plenty of affordable ways to qualify for permanent residency. Investing $80,000 into a government-certified reforestation project is the fastest route.

Note: Costa Rica also has a territorial tax structure, making it another viable option.

To qualify, you’ll also need to own five hectares of titled land in Panama. After acquiring the land and making the investment, you’ll get temporary residency then permanent residency one year later.

Those with extra capital can also take the real estate route to achieve permanent residency. All you have to do is purchase real estate worth $500,000 to qualify for the program. That’s not a bad deal considering rental yields for real estate in Panama are around 7% per year.

Panama even uses the US dollar as its currency and is only three hours away from Miami by plane. This makes it ideal for expats who want to retire with a lower cost of living and reduce their tax liabilities but still be able to visit the US regularly.

Speaking of cost of living, renting a one-bedroom apartment in Panama will cost you $400 to $750 per month depending on how close to the city center you are. Data from Livingcost.org shows that the average cost of living in Panama is 51% lower than the US.

Real estate investors will also love the 0.5% property tax rate (0.7% for properties over $250,000).

For these reasons, Panama is the best country to retire in North America.

That’s not quite the end of the story though. Travel-hungry retirees should consider the citizenship by investment options in the Caribbean. Saint Lucia is a particularly attractive option since citizenship only costs $100,000 (plus $10,000 in additional fees).

In exchange, you get to live on picturesque beaches and visit 130+ countries on a visa-free or visa-on-arrival basis. Read my full article on Citizenship by Investment: Saints Kitts vs Saint Lucia to learn more about the costs and benefits of getting a passport in the Caribbean.

Or, if island living and citizenship by investments programs aren’t your jam, you can read my full-guide on Retiring in USA vs Canada vs Mexico to find the best option in continental North America.

Best Country to Retire in South America

Much like Africa, safety is a primary factor when finding a retirement destination in South America. Particularly, the northern countries of Colombia, Guyana, and Brazil have the highest rates of violent on the continent — on par with countries like Syria and Somalia.

I’ll cut to the chase and tell you that Paraguay is the best country to retire in South America.

It’s safer than its neighbors to the north (though I still wouldn’t recommend walking alone at night) and is an extremely attractive option moneywise. First of all, it’s the easiest country on this list to get a permanent residency in.

All you have to do is deposit around $4,000 in the National Bank of Paraguay and wait for your permanent residency application to get approved. After it’s been approved (which usually takes three months or less) you’re allowed to withdraw the funds you deposited.

You don’t even need to live in the country to keep your residency permit active. All you have to do is visit Paraguay once every three years to keep your permit current. However, there are benefits to living in Paraguay.

If you spend 183 days per year in Paraguay, for three years, you’ll be eligible for citizenship by naturalization. This quick path to citizenship is a huge benefit since the Paraguayan passport is one of the strongest in the world.

In total, you’ll be able to go to 84 countries visa-free and 48 more countries on a visa-on-arrival basis. The visa-free coverage includes all of continental Latin America (except Guyana and Suriname).

You’ll also get visa-free access to all of Europe (except Belarus and Georgia) which makes it the perfect passport for those who want to travel in the Schengen Area. A combination of expansive visa-free travel and a short naturalization period? Count me in!

As if that wasn’t enough, Paraguay has the lowest taxes in South America.

Personal income tax is just 10% and the nation doesn’t even tax foreign-source income. Capital gains will only be taxed if you’re a resident in Paraguay so those only planning to visit every three years won’t have to worry about that.

This is especially impressive considering many other countries on the continent tax income at 30% or higher. Paraguay also has the lowest debt-to-GDP ratio of any country is South America. The low national debt protects it from sovereign crises like the economic collapse in Venezuela.

Its central location provides easy access to neighboring countries like Argentina, Bolivia, and Brazil — not that you’d ever get bored of the scenery since Paraguay is home to 700+ species of birds.

One caveat is that you’ll probably need to learn Spanish (or Guarani) if you plan to live in Paraguay since most of its residents don’t speak English. That’s hardly a negative though since learning new languages can be a really rewarding experience.

Ultimately, Paraguay ticks all the boxes and lives up to its name as the heart of South America.

Best Country to Retire in Oceania

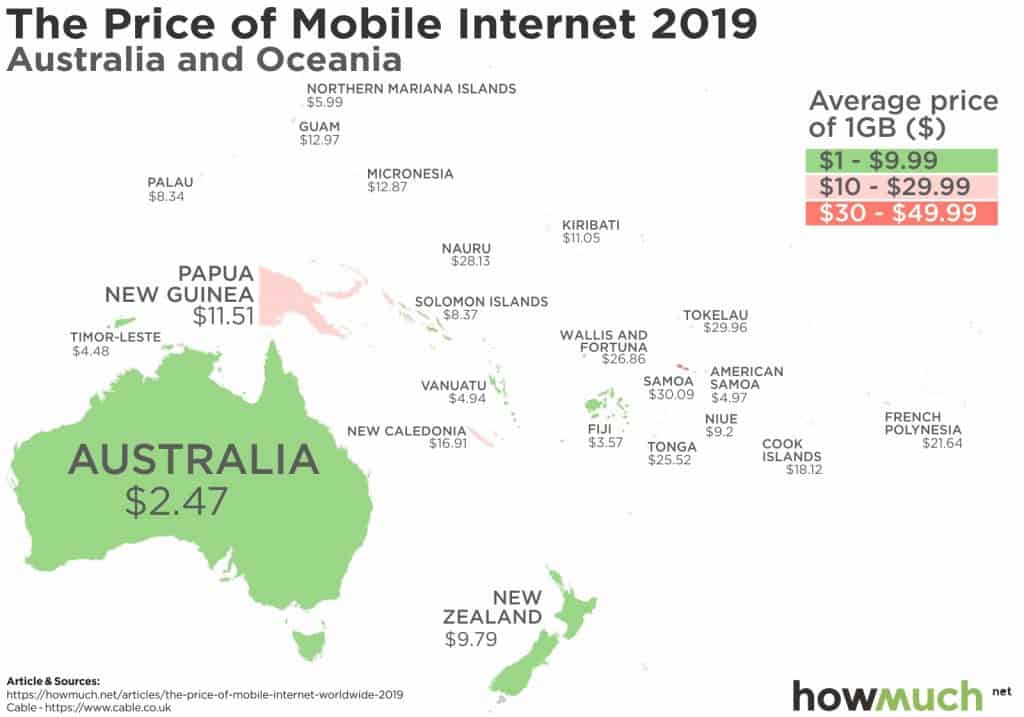

Digital nomads who choose where to live based on internet prices will likely end up in Australia or Fiji. For most of us, there’s a lot more nuance to finding the right spot to move to — especially when it comes to continents like Oceania with varying country types.

If you want to retire in Oceania but prefer countries with over a million residents then Australia, New Zealand, and Papua New Guinea will be the only three options for you. Fiji has almost 900,000 residents spread across 300+ islands but the capital city, Suva, only has 100,000 people.

Let’s start by ruling out Papua New Guinea since violent crime is quite common.

The Global Peace Index gives the country a score of five in terms of violent crime. This is the highest rating given out and puts the island nation in line with countries like Iraq or Syria. As such, let’s delve deeper into Australia and New Zealand instead.

Perth and Auckland are ideal cities with their mild climate, fast internet, and plenty of shopping malls to keep you busy. However, you’ll need to prepare a budget since renting a one-bedroom apartment in the city center of either Perth or Auckland will cost you around $1,200 per month.

Unfortunately, that price is in USD rather than AUD or NZD.

Those looking for a more islandic retirement experience will find that Vanuatu is the best country to retire in Oceania. This tax haven is home to 300,000 people across 80+ islands and imposes no personal or corporate taxation.

As such, the only taxes you’ll have to worry about are VAT (and rental income, if you’re a landlord). One of the great benefits of retirement in Vanuatu is how easy it is to immigrate to the nation.

Vanuatu’s Citizenship by Investment program lets you become a citizen by contributing to the national development fund. The necessary contribution for single applicants is $130,000. There’s also a $180,000 family package.

Contributing $180,000 will grant Vanuatu citizenship to a married couple plus two children.

Note: every additional dependent costs an extra $25,000.

In addition to being exempted from income, corporate, and capital gains tax Vanuatu citizens also enjoy free travel benefits. Vanuatu passport holders can visit 97 countries on a visa-free or visa-on-arrival basis, including:

- United Kingdom

- Ireland

- Montenegro

- Singapore

- Thailand

- Hong Kong

- Philippines

- Bahamas

- Peru

Rent prices in the capital city of Port Vila are lower than in Perth or Auckland, with one-bedroom apartments costing around $1,050 per month.

Conclusion

As you can see, there’s a great place to retire on every continent.

Again, except Antarctica.

I personally favor Europe because of how easy it is to drive between countries in the Schengen Area. If you prefer eating street food in Asia, swimming on beaches in Oceania, or exploring other continents on our planet then let this article serve as your guide.

If this article was insightful, helpful, or even entertaining then why not share it with a few friends on your social media feeds? Remember, every link you share with someone else is another opportunity for my content to help people Live After Success.